COORDINATION OF SOCIAL SECURITY – IN GENERAL

1.What is social security?

Social security are statutory schemes that are established in order to protect persons in a social situation that triggers a need for compensation of lost earnings. Social security establishes solidary schemes to which each person contributes and has reciprocal rights to benefits when needed. A social security scheme will therefore in general entail a correlation between an obligation to contribute and a right to receive a benefit. Social security is therefore not social assistance, which is offered regardless of any contributions.

Within the EU, a scheme is regarded to be a social security scheme when the benefit is provided based on objective conditions without regards to the persons individual needs for compensation.

The term social security may cover the following areas:

- Sickness benefits

- Maternity and equivalent paternity benefits

- Invalidity benefits

- Old-age benefits

- Survivor’s benefits

- Benefits in respect of accidents at work and work-related injuries

- Death grants

- Unemployment benefits

- Pre-retirement benefits

- Family benefits

Social security only regards statutory schemes. Private schemes such as private pensions, insurances or schemes governed by collective agreements are not comprised.

The Danish social security system is residence based. Persons who are resident in Denmark have social security rights and may therefore be comprised by the health system and earn seniority for the pension purposes. The Danish system is mainly financed through taxes and only minor actual social security contributions exist. In Denmark, there is in general no correlation between contributions and entitlements.

Among other EU/EEA countries it is common that the social security system is based on an insurance principle, which imply that the individual makes contributions and thereby earn the right to coverage if need be. The contributions are made by both the employer and the employee. Typically, each party pays an equal part or the employer pays 2/3 of the total contributions. Tus, the social security coverage may only comprise economically active persons and possibly the members of their families. Certain schemes may, however, cover everyone who is resident in a country.

1.1 What is coordination of social security?

Both within and outside the EU/EEA, each country has its individual social security system. This implies that each country may design its own system according to which social security benefits are granted and also define to whom and under which condition such benefits should be given.

When a person travels cross-border, the national rules may collide so that a person may risk either to gain double coverage or to obtain no coverage, should the person for example fall ill or become unemployed. In order to ensure that the different countries’ systems work properly in parallel, international rules on coordination of social security have been introduced. International rules on coordination of social security typically decide whether a person is covered by the social security legislation of one country or another (choice-of-law rules) and prevent double coverage. The rules may also govern the right for the person to export a benefit (for example old-age benefits) to another country (the right to benefits and the obligation to contribute).

1.2 The international rules on social security

The international rules on social security are coordination rules. This means that the international rules stipulate which country’s social security system applies.

The rules vary depending on the person working in- or outside the EU/EEA or if he/she is an EU/EEA citizen. Below please find an overview of the situations that may occur.

| Citizen in the EU/EEA or Switzerland | Not a citizen in the EU/EEA or Switzerland | |

|---|---|---|

|

Work within the EU/EEA or Switzerland |

As a main rule, you will be covered by the common EU rules on social security. The rules stipulate which country’s social security you will be covered by. Click here for more information |

You will be covered the same way as when working outside the EU, see below. Special rules may apply if you are going to a Nordic country. |

|

Work outside the EU/EEA or Switzerland (country of agreement)

|

As a main rule, you will be covered by an international agreement between Denmark and the work country. The agreement stipulates which country’s social security agreement you are covered by. Click here for more information |

You may be covered by an international agreement between Denmark and the country of work. The agreement stipulates which country’s social security agreement you are covered by. Click here for more information |

|

Work outside the EU/EEA or Switzerland (no agreement) |

No international rules stipulate which country’s social security agreement you are covered by. Click here for more information |

No international rules stipulate which country’s social security agreement you are covered by. Click here for more information |

1.3 I am a citizen in an EU/EEA country or Switzerland and work within the EU/EEA. Which rules exist?

1.3.1 Work within the EU/EEA or Switzerland

As an EU/EEA citizen (or citizen in Switzerland) working within the EU/EEA (or Switzerland), international EU rules exist stipulating which country’s social security system you are covered by.

The rules stipulate that you may be covered by social security in one country at a time and that you have rights and obligations according to the rules in that country. Each country decides for which rights and obligations apply. It is common that the EU countries finance their social systems through social contributions, which is typically a percentage of the gross salary. The countries also decide the level of the contributions. The contributions are typically approx. 15-30% of the gross salary.

1.3.1.1 Which rules may be relevant to me?

When you work within the EU, there are four rules that are useful to know:

1.4 Which typical situations apply to university employees?

The main principle of the rules is that you are covered by social security in Denmark when you are employed by a Danish university. Within the EU, special rules stipulate which country’s social security you are covered by when you perform multi-state work or work temporarily in another country.

1.4.1 Do I fit into a “typical situation”?

Below please find a description of some typical situations. If one of the situations is relevant in your case, please follow the link in order to read more.

1.4.1.1 I am a university employee posted to work abroad

You are a posted university employee if you are normally employed by a university in Denmark and during the employment work abroad for a limited period of time.

You may read more about the rules in this situation here.

1.4.1.2 I am a university employee posted to work in Denmark

You are a university employee posted to work in Denmark if you are normally employed by a university abroad (employed or self-employed) and then posted to Denmark to work at the Danish university for a limited period of time.

You may read more about the rules in this situation here.

1.4.1.3 I am a commuter

You are a commuter if you live in one country and perform your work in another country.

You are a commuter if you e.g. live outside Denmark and on a daily or weekly basis travel to work at the Danish university.

You may read more about the rules in this situation here.

1.4.1.4 I perform secondary work in Denmark

Your main work is abroad and parallel to this, you are employed at a Danish university to perform secondary work in Denmark.

You may read more about the rules in this situation here.

1.4.1.5 I perform secondary work abroad

Your main work is in Denmark and parallel to this, you are employed abroad to perform secondary work there.

You may read more about the rules in this situation here.

1.5 I think it is difficult to get an overview of the rules in relation to my situation

The rules on coordination of social security may be complicated, and there are many issues to consider. Below please find an overview with some questions which may guide you. You may answer the questions before, during or after you study the rules in order to have a clear overview of your situation and to sort the information on social security.

POSTING ABROAD

2. What is a posting situation?

A posting situation is typically where you are normally employed to work at a Danish university and during this employment work temporarily in another country.

Example 1

The researcher Peter Jørgensen is employed at a Danish university and lives in Denmark. As part of his research, he stays in France for 18 months to collect scientific material. He then returns to work in Denmark.

Example 2

Ph. D. Fellow Christian Petersen is employed at a Danish university. As part of his salaried Ph. D. fellowship, he stays for six months in the US.

2.1 I am a posted university employee and then what?

When working abroad while employed at a Danish university, your situation may vary depending on the country where you live.

Is it:

- A country within the EU/EEA or Switzerland?

- A non-EU/EEA country that has a social security agreement with Denmark?

- A non-EU/EEA country that has no social security agreement with Denmark?

Before continuing your reading, it should be determined which situation applies to you as the handling of your social security position depends on this.

There may be further limitations, however, as certain rules only apply to certain citizens, e.g. special rules on coordination of social security only apply to certain EU citizens (when Denmark is involved).

2.2 I am posted to work in an EU/EEA country and Switzerland

When posted from a Danish university to another EU/EEA country and Switzerland, there are rules that may keep you covered by Danish social security. Within the EU/EEA and Switzerland, there are common EU rules on coordination of social security.

It is a condition in order to apply the EU rules that you are an EU/EEA citizen (i.e. citizen in an EU/EEA country). If you are not an EU/EEA citizen, your situation will be regulated the same way as for postings outside the EU, i.e. you should investigate if a bilateral social security agreement exists between Denmark and the host country.

2.3 When am I covered by Danish social security?

There are two sets of rules within the EU stipulating that you may remain covered by Danish social security.

These are:

- Rules for civil servants

- Rules for posted workers

You are a civil servant if you are employed at a Danish university. As a main rule, you should therefore only observe the rules for civil servants. If you are in doubt if you are a civil servant, you should contact your HR department at your university in order to clarify if this is the case.

Note! The rules only apply if you are an EU citizen. If you are not an EU/EEA citizen, your situation will be the same as if you were posted outside the EU/EEA.

2.4 What should I do as a civil servant employed at a Danish university?

When working in another EU/EEA country as a Danish civil servant, you will always be covered by Danish social security. Your employment at the Danish university should be your only employment as a civil servant. In this situation, you do not need to worry about your work pattern or how long you have worked abroad.

Example 1

Christian Thomsen works temporarily for three months in Italy for his Danish university. Christian Thomsen lives in Denmark and pays Danish tax.

Christian Thomsen is covered by Danish social security as he is a civil servant in Denmark. It is of no importance for his social security position that he lives in Denmark and pays tax in Denmark.

Example 2

Jørgen Jørgensen is posted from a Danish university to work in Germany for five years. He moves his residence to Germany and pays tax in Germany.

Jørgen Jørgensen is covered by Danish social security. It is of no importance that he lives in Germany or pays tax in Germany.

2.4.1 I am a civil servant and work in an EU/EEA country. What is the next step?

You should apply for a certificate stating that you are covered by Danish social security (A1 certificate). The certificate may be obtained with the Danish social authorities - Udbetaling Danmark – International Social Sikring. You should fill in this questionnaire and file it with the authorities at isos@atp.dk.

The certificate is not designed to handle civil servants. You should therefore fill in items 1, 2, 4 and 10 in the application. In item 10 “Other comments”, you should state that you are a civil servant. You may also use the electronic application form at virk.dk if you have a NemID. Make sure to provide a copy of the A1 certificate to the university.

2.5 I am posted to a non-EU/EEA country that has a social security agreement with Denmark

When you are posted from a Danish university to a non-EU/EEA country that has a social security agreement with Denmark, there is a good chance for you to remain covered by Danish social security.

2.5.1 Which rules to apply to remain covered by Danish social security?

The rules in a social security agreement stipulate that you remain covered by Danish social security.

The rules are:

- Rules on civil servants

- Rules on posted workers

The Danish rules stipulate if you are a civil servant employed at a Danish university. If you are in doubt if you are a civil servant, you should contact the HR department at your university in order to clarify if this is the case.

Note! You should investigate if the agreement applies in your situation. It may be the case if the agreement only applies to persons with certain citizenships. If the agreement does not apply in your situation, your situation will be the same had you been posted to a country that has no social security agreement with Denmark.

2.5.2 Can I remain covered by Danish social security?

2.5.2.1 Civil servant

The social security agreements with Denmark include a special provision so that you will be covered by the Danish rules on social security as a civil servant in Denmark.

You should therefore investigate the provisions in the agreement covering the country to which you are going to be posted.

You should note that the agreement may be limited to only apply to citizens in Denmark and the country where you work temporarily. If the agreement does not apply to you as a university employee, you should investigate if the agreement includes a special posting rule that applies to you anyway.

Example

The university professor Kim Nielsen is going to work on a project in the US for four years. Kim Nielsen moves to the US with his family during the period. Denmark has an agreement with the US stipulating that Kim Nielsen as a civil servant may remain covered by Danish social security during the entire period. The rule only applies to national pensions (old age pension and the Danish Labour Market Supplementary Pension – ATP). It should be considered if contributions should be made to the national systems in the US that not covered by the agreement. Any accompanying family members will not be covered by Danish social security when the rule on civil servants applies. Other social security schemes not covered by the agreement, are not coordinated and therefore treated solely on the basis of national legislation.

2.5.2.2 Postings

Note! The below description also applies if you are posted within the EU and if you are not a citizen in an EU country, but posted to a country that has a social security agreement with Denmark.

The posting rules stipulate that you may remain covered by Danish social security while working abroad. This is a time-limited possibility, though.

You should investigate what the rules say in your situation regarding:

- For how long can I be posted?

- Is it a requirement that I have had a residence in Denmark for a period prior to my posting?

- To what extend should I be covered by Danish social security prior to my posting?

If you have lived and worked permanently in Denmark prior to the posting, you will normally fulfil the conditions.

The posting rule may vary from the rule on civil servants by only allowing temporary work to be performed in the host country under Danish social security. In some situations, however, the posting rule also covers accompanying non-working family members.

Example

Dan Petersen is a Ph. D. student at a Danish university. Dan is a Danish citizen and lives in Denmark. As part of his Ph.D, he is going to study for six months in the US. Denmark has a social security agreement with the US determining that he and his accompanying family may remain covered by Danish social security for up to three years. Please note that when applying the posting rule, the accompanying family is also covered. The agreement only regards national pensions (old age pension and the Danish Labour Market Supplementary Pension – ATP). Other social security schemes not covered by the agreement are not coordinated and therefore treated solely on the basis of national ruling.

2.5.3 I am covered by a social security agreement. What is the next step?

You should apply for a certificate stating that you are covered by Danish social security (Certificate of Coverage or CoC). The certificate may be obtained with the Danish social authorities - Udbetaling Danmark – International Social Sikring. You should fill in this questionnaire and file it with the authorities at isos@atp.dk.

The certificate is not designed to handle civil servants. You should therefore fill in items 1, 2, 4 and 10 in the application. In item 10 “Other comments”, you should state that you are a civil servant, unless you apply under the posting rule. If you do so, you should state this in the application instead. You may also use the electronic application form at virk.dk if you have a NemID. sure to provide a copy of the CoC to the university.

2.6 I am posted to a non-EU/EEA country that has no social security agreement with Denmark

Note! This section also applies if you are posted within the EU, without being an EU citizen and the work country has no social security agreement with Denmark.

Note! The section also applies if you are posted outside the EU to a country that has no social security agreement with Denmark, but where the agreement does not apply to you.

When posted to a non-EU/EEA country that has no social security agreement with Denmark, no international rules stipulate which country’s rules on social security you are covered by.

The rules in both Denmark and the work country will thus stipulate if you are covered by different social security systems.

This means:

- That you may be covered by systems in both countries at the same time

- That you may be covered by no systems

- That you may be covered by Danish systems only

- That you may be covered only by systems in the country where you work temporarily

According to local rules in some countries, you and the Danish university will be obliged to contribute to the social security system during the posting.

2.6.1 I am not covered by a social security agreement. What is the next step?

You should discuss further with the HR department at the university which measures to be taken.

INBOUND POSTING

3. What is an inbound posting?

An inbound posting is typically a situation where you normally work in a foreign country for a foreign university and as part of this employment, you are posted on a temporary basis to perform work in another EU/EEA country. Thus, you are posted from a foreign university to Denmark.

In relation to the rules on coordination of social security, there are no specific rules for persons posted to Denmark. There are normal rules on social security, including the rules for civil servants, postings, etc.

Example 1

The researcher John Johnson is employed at a UK university and lives in the UK. As part of his research, John Johnson will go to Denmark for 18 months in order to collect scientific material. In order to determine which country’s social security John Johnson is covered by, his situation should be reviewed based on the below descriptions.

Example 2

Ph. D. fellow Johanna Carlsson is employed at a Swedish university. As part of her Ph.D., she will go to Denmark for six months. In order to determine which country’s social security Johanna Carlsson is covered by, her situation should be reviewed based on the below descriptions.

Note! If you are employed at a Danish university, and you are also a civil servant abroad, you may read more in section 4.3.4.

3.1 I am a posted university employee

When posted to a Danish university, your situation may vary depending on which country you are posted from.

There are different rules, depending on which country you come from:

- A country within the EU/EEA (and Switzerland)

- A non-EU/EEA country that has a social security agreement with Denmark

- A non-EU/EEA country that has no social security agreement with Denmark

3.2 I am posted from a country within the EU/EEA and Switzerland

When posted to a Danish university from another EU/EEA country or Switzerland, it is likely that you will remain covered by your home country’s social security. Within the EU/EEA, there are special common rules for coordination of social security.

Note! It is a condition for applying the EU rules that you are an EU/EEA citizen (i.e. citizen in an EU/EEA country). If you are not an EU/EEA citizen, your situation will be handled the same way as for postings outside the EU.

3.2.1 When am I covered by social security in my home country?

There are two rules within the EU determining if you will be covered by your home country’s social security.

The rules are:

- Rules for civil servants

- Rules for posted workers/self-employed employees

Your home country’s rules stipulate if you are a civil servant according to the coordination rules. It varies from EU country to EU country if a university employee is to be regarded as a civil servant. If you are uncertain if you are a civil servant, you should contact the HR department at your university to have this clarified.

3.2.2 What should I do when I, being a civil servant in my home country, is posted to Denmark?

When you work in Denmark while being a civil servant in your home country (i.e. the country from which you are posted), you will always be covered by your home country’s social security. You need not worry about your work pattern or for how long you have been posted.

Example 1

James Watson is a UK citizen and posted from a UK university to work in Denmark for three months. James Watson lives in the UK and pays UK tax. He is a civil servant in the UK. James Watson is thus covered by UK social security. It is of no importance for his social security position that he lives in the UK and pays tax in the UK.

Example 2

Anita Norström is a Norwegian citizen posted from a Norwegian university to work in Denmark for five years. She moves her residence to Denmark and pays tax in Denmark. Anita Norström is a civil servant in Norway and thus covered by Norwegian social security. It is of no importance for her social security position that she lives in Denmark and pays tax in Denmark.

3.2.3 I am a posted civil servant. What is the next step?

You should contact the authorities in your home country (the country from which you are posted) and apply for a certificate stating that you are covered by your home country’s social security. Make sure to provide a copy of the A1 certificate to the university.

3.2.4 I am a posted university employee but not a civil servant or self-employed person in my home country

3.2.4.1 Posted university employee (not a civil servant)

As a posted university employee, you must fulfil five conditions in order to remain covered by your home country’s (i.e. the country from which you are posted) social security system. The conditions are:

- Your posting to Denmark must not exceed 24 months (the authorities may grant an exemption from the number of months)

- You must have been covered by your home country’s (i.e. the country from which you are posted) social security system prior to your posting

- You must have a work relation to your employer in the home country

- You must not replace another posted university employee.

- Your employer in your home country must have a certain turnover (minimum 25%)

If you are a posted university employee, you should contact the authorities in your home country and apply for an A1 certificate stating that you are covered by your home country’s social security system.

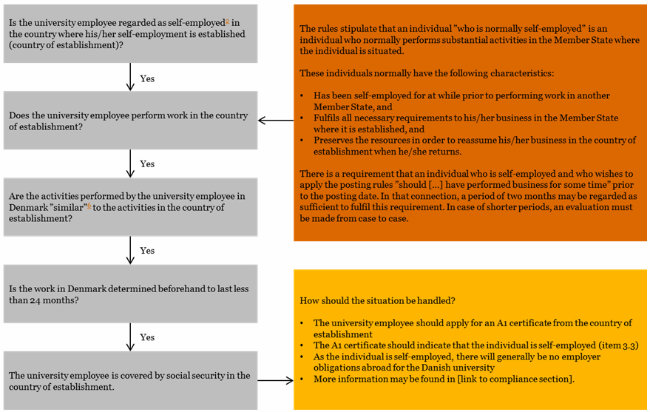

3.2.4.2 Posted self-employed person

As a posted self-employed person you must fulfil four conditions in order to be able to remain covered by your home country’s (i.e. the country from which you are posted) social security system. The conditions are:

- The employment abroad (i.e. in Denmark) must not exceed two years (the authorities may agree to extend the period)

- You must be covered by social security in your home country as you are self-employed in that EU/EEA country.

- The activities you perform in Denmark must be similar to the activities you perform at home

Read more about the conditions in section 5.3.2.

You may be a posted self-employed person even if you have a local employment contract directly with the Danish university.

3.2.5 I am a posted (not civil servant) university employee or self-employed person. What is the next step?

If you are a posted university employee or self-employed person, you should contact the authorities in your home country (i.e. the country from which you are posted) and apply for an A1 certificate stating that you are covered by your home country’s social security. Make sure to provide a copy of the A1 certificate to the university.

3.3. I am posted from a non-EU/EEA country that has a social security agreement with Denmark

As a posted university employee to a Danish university from a non-EU/EEA country that has a social security agreement with Denmark, it is likely that you will remain covered by your home country’s social security.

3.3.1 When am I covered by my home country’s social security?

There are typically two rules in the social security agreement stipulating that you may remain covered by your home country’s social security. The rules are:

- Rules for civil servants

- Rules for posted workers

Your home country rules decide if you are a civil servant according to the coordination rules. It varies much from country to country if the university employees are regarded as civil servants. If you are uncertain if you are a civil servant, you should contact the HR department at your university to have this clarified.

3.3.1.1 Civil servant

You should investigate the possibility for you to remain covered by your home country’s social security as a civil servant. You should contact the authorities in your home country to find out if you are a civil servant according to the rules on coordination of social security.

The social security agreements entered by Denmark, usually contains a special provision stating that you, as a civil servant, will be covered by your home country’s social security when posted to Denmark.

Please note that the social security agreement may be limited to only apply to citizens in Denmark and the country in question. If the agreement does not apply in your situation, you should investigate if the agreement includes a special posting rule applying in your situation.

3.3.1.2 Posting – university employee (not a civil servant)

Note! The below description also applies if you are posted to Denmark from an EU/EEA country, but you are not a citizen in an EU/EEA country

If the social security agreement does not apply to you due to your citizenship, the agreement may contain special posting rules for employees which may apply irrespective of citizenship. You should investigate this further with the HR department at your university.

If you are covered by the posting rule, there are limitations, however, as to how long you may work in Denmark and still be covered by social security in your home country.

You should further investigate the posting rules’ requirements for:

- How long you have been posted to Denmark.

- If you must have had a residence in your home country for a period prior to the posting from the home country (i.e. the posting to Denmark).

- To which extend you must be covered by social security in your home country prior to the posting to Denmark.

If you have lived and worked permanently in your home country prior to the posting to Denmark, you normally fulfil the requirements.

Your home country’s social security rules normally stipulate if the rules may be applied.

3.3.1.3 Posting – self-employment

If you are self-employed, there are special rules on posting of self-employed persons in the social security agreement.

You should investigate with the HR department at the university if such provision is relevant to you.

Your home country’s social security rules normally stipulate if you are self-employed.

3.3.2 I am a posted university employee from a non-EU/EEA country that has a social security agreement with Denmark. What is the next step?

You should contact the authorities in your home country (i.e. the country from which you are posted) and apply for a certificate stating that you are covered by your home country’s social security rules.

3.4 I am posted from a non-EU/EEA country that has no social security agreement with Denmark

Note! The below description also applies if you are posted within the EU, but you are not an EU citizen.

When posted to Denmark from a non-EU/EEA country that has no social security agreement with Denmark, there are no international rules to stipulate where you are covered by social security.

The rules in Denmark and your home country determine if you are covered by different social security systems.

This means:

- That you may be covered by systems in both countries at the same time.

- That you may be covered by no systems.

- That you may be covered by Danish systems only.

- That you may only be covered by systems in the home country.

You should discuss further with the HR department at the university how to handle this.

WORK IN SEVERAL EU/EEA COUNTRIES FOR A DANISH UNIVERSITY (MULTI-STATE WORKER)

4. What does it mean to work in several EU/EEA countries?

Note! The below description is only relevant if you are an EU citizen and work within the EU/EEA.

When performing multi-state work within the EU/EEA and Switzerland, there are rules for persons who normally work in two or several countries (multi-state worker).

4.1 How do I know if I am a civil servant, university employee, self-employed or student?

The rules in the country where the university is situated decide if you are a civil servant. If you are employed at a Danish university, you will be a civil servant in Denmark. You will be a civil servant in Denmark, no matter where in the EU/EEA you work.

The national social security rules in the country where you perform your work determine if you are a university employee or self-employed. Your status in each EU/EEA country may therefore change when you change work country. Your status will change, even if the employment remains the same.

If you are not a civil servant, university employee or self-employed, you will probably be a student in an EU/EEA country.

4.2 When do I work ”normally” in several countries?

In order for the multi-state rules to apply, you must work ”normally” in several countries. It does not take much for your work to be regarded as “normal” in several countries. A secondary job or a non-habitual but sporadic task in another country than the country where you normally work will be sufficient for you to be covered by the rule.

As a main rule, however, the rules are meant to apply to persons who have a permanent work pattern in more than one EU country.

Some rules and principles have been laid down in order to determine if you are a multi-state worker:

- The multi-state work may be permanent or sporadic.

- The multi-state work must take place within the next 12 months.

- The multi-state work must be performed at the same time or in turns.

- The multi-state work must be predictable. This is the case if it is stated in the contract or if it follows the nature of the job.

- Work in a country is disregarded if it is marginal (i.e. minor work typically accounting for less than 5% of the total working time/salary).

Example 1

Heinz-Dieter Steinmayer is employed at a Danish university. Thus, he primarily performs work in Denmark. At the same time, he works on a research project in Zurich. He therefore has sporadic business trips to Switzerland, but also gives lectures in Vienna and Mainz.

Heinz-Dieter Steinmayer is covered by the multi-state rules. The posting rules should also be considered.

Example 2

Eberhard Eichenhoff is employed at a German university and works in Germany. At the same time, he has a secondary job at a Danish university where he works permanently approx. two days a month.

Eberhard Eichenhoff is covered by the multi-state rules.

Example 3

Johan Josefsen is employed at a Danish university. At the same time, he is elected for the board in a Belgian foundation to which he contributes with his expert knowledge. There are approx. six board meetings a year. The meetings are held in different EU/EEA countries, but the countries are not decided beforehand.

Johan Josefsen may be covered by the multi-state rules.

4.3 Where am I covered by social security if I am a multi-state worker?

You will be covered by social security in one of the following countries:

- In the country where you are a civil servant

- In the country where you work as salary earner

- In the country where your residence is, or

- In the country where your employer is situated

There are special rules determining where you are covered by social security. The rules may be very technical, and in the following we have made an overview. If your situation does not match the below, you may seek further guidance at the Danish university.

4.3.1 I am a civil servant in Denmark and work in several countries in the EU/EEA

As a civil servant in Denmark with no other employers, you will always be covered by social security in Denmark. You may therefore work as you wish in the EU/EEA without it causing any problems.

Example 1

Ann-Kathrine is employed at a Danish university. She participates in a major excavation in a Greek temple ruin and therefore performs part of her work in Greece for a period of four years. Ann-Kathrine is covered by Danish social security during her work in Greece.

Ann-Kathrine is covered by Danish social security because she is a civil servant in Denmark.

Example 2

Jaqueline Costeau lives in France with her family, but is employed at a Danish university. The family remains in France for the first six months, and Jaqueline Costeau commutes to Denmark. Part of her work is performed from home in France, but the main part of the work is performed in Denmark.

Jaqueline Costeau is covered by Danish social security because she is a civil servant in Denmark.

4.3.2 I am a civil servant in Denmark and perform work in several countries in the EU/EEA – what is the next step?

You should apply for a certificate stating that you are covered by Danish social security (A1 certificate). The certificate may be obtained with the Danish social authorities - Udbetaling Danmark – International Social Sikring. You should fill in this questionnaire and file it with the authorities at isos@atp.dk.

The certificate is not designed to handle civil servants. You should therefore fill in items 1, 2, 4 and 10 in the application. In item 10 “Other comments”, you should state that you are a civil servant. You may also use the electronic application form at virk.dk if you have a NemID.

It is common that the authorities only issue the A1 certificate for one year at a time. You should therefore apply for a new certificate upon expiration. Make sure to provide a copy of the A1 certificate to the university.

4.3.3 I am a civil servant in Denmark and also employed/self-employed in another EU/EEA country

When you are a civil servant in Denmark and also has an employment (not as a civil servant) with another employer in another EU/EEA country (or self-employed in another EU/EEA country), you are always covered by social security in Denmark.

As long as you are only a civil servant in one country, this is decisive for where you are covered by social security. It has no importance which employments or businesses as self-employed you have in other EU/EEA countries.

You may therefore work as you wish within the EU/EEA without it causing any problems in relation to social security. The work for the Danish university should constitute at least 5% in one EU/EEA country.

Example

Monique Robert lives in Belgium and is employed at a Danish university. After the employment in Denmark, she is hired as a consultant for a German company. The work as a consultant in Germany is regarded as self-employment according to German social security rules.

Monique Robert works in several countries both as a civil servant and as self-employed. The employment as a civil servant determines which country’s social security system she is covered by. Monique Robert is therefore covered by the Danish rules on social security during her work in an EU/EEA country.

4.3.4 I am a civil servant in Denmark and also have a public employment in another EU/EEA country

If you are a civil servant in Denmark and parallel to this have another public employment in another EU/EEA country, you are no longer automatically covered by social security in Denmark.

The fact that you are a civil servant in two countries means that the situation is regulated according to the multi-state rules.

Please note that the national rules in each country determine if you are a civil servant or not. An employment at a university outside Denmark will therefore not automatically imply that you are a civil servant in that country.

4.3.5 I am a civil servant in two countries (the multi-state rules apply)

You are covered by social security in one of the following countries:

- Country of residence

- Employer home country

If the work in the country of residence is substantial (25% or more of the working time/salary), this may be decisive for which country’s social security system applies. It is also decisive if you have several civil employers in two or several EU/EEA countries in addition to your Danish university employment.

The below overview shows where you are covered by social security. It is a condition that you keep your Danish public employment and has at least one other public employment outside Denmark:

| Work in country of residence is substantial (more than 25% of working time/salary) | Work in country of residence is not substantial (less than 25% of working time/salary) | |

|---|---|---|

| You have one other public employer in another EU/EEA country in addition to your Danish university employment. You live in one of the countries where one of your employers is situated. | You are covered by social security in your country of residence. | You are not covered by social security in your country of residence, but in the other country where you have an employer. |

| You have at least two other employers in addition to your employment at the Danish university, and at least one of these employments is a public employment. These employers are situated in at least two countries which are not Denmark. | You are covered by social security in your country of residence. | You are covered by social security in your country of residence. |

4.3.6 I am a civil servant in two or more countries and also self-employed

If you are a civil servant in at least two countries and also have employments as a salary earner, and parallel to this is self-employed in a third EU/EEA country, your employments determine where you are covered by social security. In other words, the employment(s) overrules self-employment.

The self-employment has no importance. It does not count either that the work in your country of residence is substantial (more than 25% of working time/salary).

4.4 I normally work in several countries. What is the next step?

When working in several countries as a civil servant and also as a university employee/self-employed, you should contact the authorities in your country of residence to have them certify where you are covered by social security.

When it has been decided where you are covered by social security the authorities in this country issue an A1 certificate stating where you are covered by social security. The certificate is valid in all EU/EEA countries. It is common that the authorities only issue the certificate for one year at a time. You must apply for a new certificate upon expiration. Make sure to provide a copy of the A1 certificate to the university.

COMMUTERS

5 What is meant by commuter?

You are a commuter if you live in one country, while working continuously in another country.

Thus, you are a commuter if you live in another country than Denmark and work continuously at the Danish university.

5.1 Social security in relation to me and my family

As a commuter within the EU/EEA, you will be covered by only one country’s rules on social security. Please find below a description of which country’s rules you will be covered by.

Even if you are covered by the rules of another country than your country of residence – e.g. Danish rules – your family will still have certain rights in the country of residence. See below.

The coverage you receive within the EU/EEA also applies to your family under certain circumstances. You and your family will thus not remain uncovered when you become covered by social security in another country than your country of residence.

Initially, the rules only apply to persons who are citizens in an EU/EEA country. However, the rules also apply to non-EU citizens who reside in a Nordic country (Norway, Sweden, Finland or Iceland). The nationality of your non-working family members is of no consequence.

5.2 Which country’s rules on social security apply to me?

When you commute to perform your work at a Danish university, you will be covered by the Danish rules on social security. You are employed as a civil servant in Denmark and you will thus always be covered by Danish social security no matter where you work within the EU/EEA.

5.3 Are there any exemptions to the rule on Danish social security?

Yes. There are several exemptions – and you should consider whether they apply to you.

Exemptions:

- You are self-employed in your home country and only performs work in Denmark temporarily.

- You work in multiple countries for several public employers (outside your country of residence).

- You are a civil servant in your home country.

See below.

5.3.1 Multi-state workers (Communters / Secondary job in Denmark)

5.3.2 I am self-employed in my home country and will perform a temporary task in Denmark

Note! The following rules only apply within the EU/EEA and Switzerland. If you come from a country outside the EU/EEA or Switzerland, similar rules may apply in a social security agreement.

You will be covered by social security in your home country if you are self-employed in your home country but are going to work in Denmark at a Danish university for a limited period.

There are rules on postings of self-employed persons, which means that you as a self-employed can remain covered by your home country’s social security. You can avoid entering the Danish social security system for a limited period.

A number of conditions must be met for you to remain covered by your home country’s social security. The conditions in brief:

- The work abroad (i.e. in Denmark) may not exceed two years (the authorities may agree on an extension).

- You will be covered by your home country’s social security, as you are usually self-employed in the EU/EEA country in question.

- The activities to be performed in Denmark must be similar to the activities you perform at home.

5.3.2.1 Time-limited work for two years

If the work in Denmark is time-limited, but exceeds 24 months, you should discuss this issue with the HR department at the Danish university and the authorities in your home country; see below the possibility of applying for a special agreement.

5.3.2.2 Self-employed in your home country

You must be a self-employed researcher according to the rules in your home country. If in doubt, contact the authorities and inquire into your status in relation to coordination of social security in the EU. It is not necessarily the same status, which applies to your work- and tax-related conditions in your home country.

It is not a condition that you live in your home country (the country from which you are posted), even if it will probably be the case for most commuters.

5.3.2.3 Similar activities

It is a requirement that the activities you perform in your home country are similar to the activities you have to perform in Denmark. It is not a requirement that the activities are the same or that the activities depend on each other. It is sufficient that the activities are within the same line of business, e.g. academic work/research.

5.3.2.4 Special agreements between two EU/EEA member states

Often, the authorities in your home country will have a practice of entering into specific agreements with the Danish/foreign authorities so that you can remain covered by your home country’s social security for a period exceeding 24 months. How long a period the authorities will accept, varies from country to country.

There may also be a practice stating that you do not have to meet one or more of the other requirements when the work in Denmark is temporary. You should contact the authorities in your home country to discuss the possibilities for remaining covered by your home country’s social security system.

5.3.3 I am self-employed and posted from my home country. What is the next step?

When you are self-employed and posted from your home country, you should contact the authorities in your country of residence and have them make a decision on which country’s social security you are covered by.

The authorities in your home country will decide whether you can remain covered by your home country’s social security. If a special agreement is required, the authorities will make the agreement, however, please note that you may have to file a specific application for such a special agreement.

If you remain covered by your home country’s social security, the authorities will issue an A1 certificate as valid documentation in Denmark (and all EU/EEA member states) that you are only covered by your home country’s rules on social security. The certificate can be used as documentation so that you do not have to pay social contributions in Denmark and can continue contributing to the social security system in your home country. It is common that the authorities issue a certificate for the entire posting period. Make sure to provide a copy of the A1 certificate to the university.

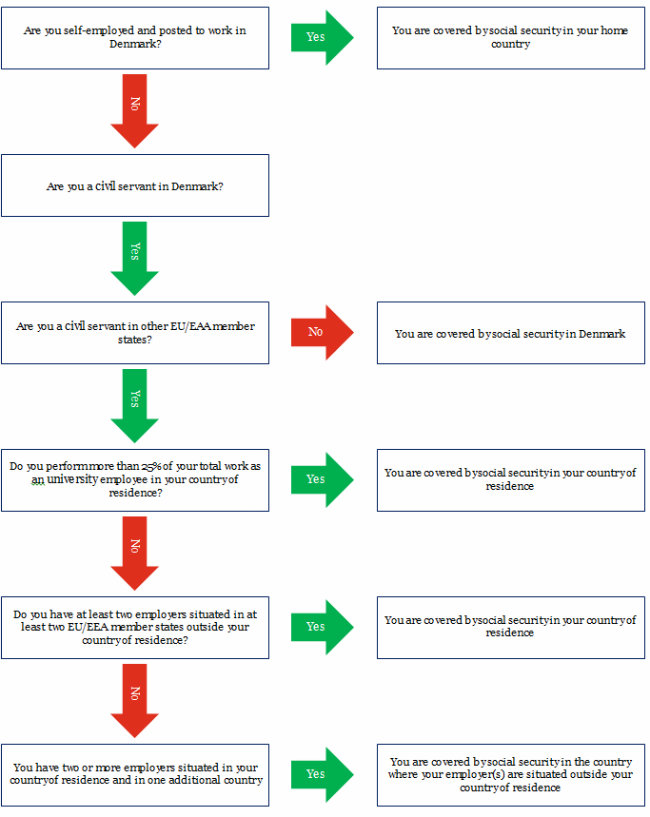

5.3.4 I am a multi-state worker and have several public employers (outside my country of residence)

When you have two public employers in two countries outside your country of residence, you are always covered by social security in your country of residence.

Example

Ola Håkonsson lives in Malmö and is employed at a Danish university in the greater Copenhagen area – he commutes to the university. He is a civil servant in Denmark. Ola Håkonsson is also employed at a university in Hamburg where he is also a civil servant.

Ola Håkonsson is covered by Swedish social security, i.e. the rules in the country of residence, because:

- He works at a Danish university as a civil servant.

- He works at a German university as a civil servant.

- He lives in Sweden.

5.3.5 I am a multi-state worker and have several public employers. What is the next step?

When you are a multi-state worker and have several public employers, you should contact the authorities in your country of residence and have them make a decision on which country’s social security you are covered by.

You should always apply to the authorities in your country of residence when you are a multi-state worker, even if you believe that according to the rules you should be covered by a different country’s rules than your country of residence. When the authorities in your country of residence have received your application, they will coordinate with the authorities in the other EU/EEA member states.

The authorities will issue an A1 certificate as valid documentation in all EU/EEA member states that you are only covered by that country’s rules on social security. The certificate can be used as documentation so that you do not have to pay social contributions in other EU/EEA member states. It is common that the authorities only issue a certificate for one year. Thus, you have to apply for a new certificate upon expiry. Make sure to provide a copy of the A1 certificate to the university.

5.3.6 I work at a Danish university and is a civil servant in my country of residence. Which country’s rules on social security apply?

When you have public employers in two countries, one (or more) in Denmark and one (or more) in your country of residence, you are no longer covered by social security in the country where you are a civil servant.

Instead, you are covered by a special multi-state rule. The rule implies that you will be covered by your country of residence’s rules on social security if you perform a significant part (25% or more) of your total work in your country of residence. If you do not perform a significant part of the work in your country of residence, you will be covered by social security in the country of the other employer.

If you have a third public employment in an EU/EEA member state outside Denmark and your country of residence, you will always be covered by social security in your country of residence.

5.3.7 I work at a Danish university and is a civil servant in my country of residence. What is the next step?

When you are a multi-state worker and have several public employers, you should contact the authorities in your country of residence and have them make a decision on which country’s social security you are covered by.

You should always apply to the authorities in your country of residence when you are a multi-state worker, even if you believe that according to the rules you should be covered by a different country’s rules than your country of residence. When the authorities in your country of residence have received your application, they will coordinate with the authorities in the other EU/EEA member states.

The authorities will issue an A1 certificate as valid documentation in all EU/EEA countries stating that you are only covered by that country’s rules on social security. The certificate can be used as documentation so that you do not have to pay social contributions in other EU/EEA countries. It is common that the authorities only issue a certificate for one year. Thus, you have to request a new certificate upon expiry. Make sure to provide a copy of the A1 certificate to the university.

You should contact the HR department at your places of work and inform them of the situation as it affects your employers that you are covered by social security in your country of residence.

5.4 How do I know if I am a civil servant abroad/in my country of residence?

The social security rules in the employment country determine if you are a civil servant or not.

It varies greatly if the individual EU country treat university staff as civil servants, salary earners, self-employed or students.

To be a civil servant you must be considered a civil servant by the administration in the country in which the university is situated. It does not matter that you are associated to a research unit/facility abroad.

Example

The Norwegian researcher Bjørn Uhlmann, who lives in Norway, is employed at the university in Oslo to perform work at ESS in Lund. He performs the work in Lund and returns to Norway each weekend. As he is employed at the university in Oslo, the Norwegian rules determine if he is a civil servant in Norway.

If you are in doubt, you should contact the authorities in your home country and ask if you are a civil servant in relation to coordination of social security within the EU/EEA.

If the question remains undecided, you should inform the HR department at the Danish university.

5.5 When am I a civil servant at the Danish university?

Employments at Danish universities are public employments and you are considered a civil servant.

This is the case for all employments in research positions according to the position setup.

Certain temporary employments such as freelance employments are not civil service employments.

If you are in doubt, whether you are a civil servant, you may contact the HR department at the university.

5.6 When do I perform a significant part of my work in my country of residence?

Significant part of your work in your country of residence means 25% or more of your total work.

The work is determined based on time and/or salary. If the work/time spent at the various positions does not reflect the salary split, the time spent on the work is decisive.

Example

The researcher Mats Petterson lives in Malmö and is employed to work 100% at a Danish university in the greater Copenhagen area. He is a civil servant in Denmark. However, he performs 10% of his work from his home in Sweden. In Sweden, he teaches an evening class at Lund’s university – equivalent to 10% of a full-time position.

The total salary earned by his work in Denmark constitute 90% after currency conversion. Mats finds the teaching exciting and spends more time than expected on preparation. His students are also very hardworking and hand in written papers which have to be reviewed. Thus, the work in Sweden takes up 30% of this total working time.

In this situation, Mats will be covered by Swedish social security, because:

- He has two (or more) public employments, one in Denmark and one in Sweden (country of residence), and

- He performs a significant part (more than 25%) of his total work in the country of residence.

5.7 How do I know where my residence is?

Your residence is where your centre of vital interests is.

Even if you may have several accommodations available, you can only have one residence. The residence can be located either within the EU/EEA or outside.

Your residence will usually be where you live with your closest family, i.e. cohabitant, spouse and children if any.

It does not matter which national register you are registered in, but the authorities will take it into consideration.

If you do not know where your residence is, you should contact the HR department at the Danish university.

SECONDARY JOB IN DENMARK

When you have a secondary job at a Danish university, you should examine whether the secondary job in Denmark affects your social security.

You, the Danish university and other employers may experience significant financial and administrative consequences in connection with secondary jobs and consequently it should always be coordinated with your employers before you take up any secondary jobs.

6 Is it possible to be covered by Danish social security if I have a secondary job in Denmark?

Yes. In some situations.

In most situations though, you will be covered by social security abroad.

If your situation does not match the below example, you should read the parts on multi-state work and also contact the HR department at the university.

7 Situations, when Danish social security coverage is always possible

In the below situation it is always possible to be covered by Danish social security when you have a secondary job in Denmark. It does not matter in which EU/EEA member state you have your main job.

7.1 Secondary job in Denmark for a public employer – no other public employments

When you are employed at a Danish university, you will be a civil servant and covered by Danish social security.

According to Danish rules, university employees are civil servants and as a main rule always covered by Danish social security even if you also work abroad.

It does not matter how large a part of the work you perform abroad. However, the work in Denmark must exceed 5% of your total work.

The rules are further described in section 4.3.1.

8 Situations, when Danish social security is sometimes possible

8.1 Residence in Denmark – secondary job in Denmark for a public employer and secondary job for a public employer in another EU/EEA member state – main job as self-employed

When you are employed at a Danish university, you will be a civil servant.

When you have two public employments in two EU/EEA member states, the rules on multi-state work apply.

The employment relation “overrules” the activities as self-employed. This means that your main job as self-employed is disregarded. Your activities are only based on your secondary jobs. Which country’s social security rules to apply, is determined according to the rules for multi-state salary earners.

When you have two public employers in two different EU countries, and you live in one of these countries, you will be covered by social security in your country of residence if a significant part (25% or more) of the work for all your secondary jobs is performed in your country of residence. If you do not perform a significant part of your work in your country of residence, you are covered by social security in the country where the other public employer is domiciled.

The rules are further described in sections 4.3.4 to 4.3.6.

Example

Poul Andersen lives in Denmark and his main job is self-employed at a German university. Poul Andersen also has a secondary job in Denmark and a secondary job in Sweden. Both secondary jobs are civil service employments. The work in Germany constitutes 85% of the total work. The work in Denmark constitutes 5% and the work in Sweden constitutes 10%.

Since Poul Andersen has two public employments in two EU/EEA member states, these public employments are treated according to the rules for multi-state work and not according to the rules for civil servants. The employment relation “overrules” the activities as self-employed and Poul Andersen’s activities are only based on the employments in Denmark and Sweden. Poul Andersen thus performs 33% of his work in Denmark and 66% in Sweden.

As the work in Denmark constitutes a significant part (25% or more), Poul Andersen is covered by Danish social security.

9 Situations, when Danish social security is never possible

9.1 Residence abroad – secondary job in Denmark for a public employer – main job for a public employer in the country of residence

When you are employed at a Danish university, you will be a civil servant.

When you have two public employments in two EU/EEA countries, the rules on multi-state work apply.

If you perform a significant part (25% or more) of your work in your country of residence, you will be covered by social security in that country.

The rules are further described in section 4.3.4 and onwards.

SECONDARY JOB ABROAD

When you are employed at a Danish university, you should examine whether a possible secondary job abroad affects your social security.

You and the Danish university may experience significant financial consequences in connection with secondary jobs and consequently it should always be coordinated with the HR department at the university before you take up any secondary jobs abroad or for a foreign employer.

10 Is it possible to be covered by Danish social security if I have a secondary job abroad?

Yes. It is possible to have secondary job abroad without this affecting your social security position.

In many situations, it will be completely unproblematic, in some situations you must ensure that certain conditions are met, while in other situations it will almost always affect your social security. You should investigate what would be the case in your situation.

If your situation does not match the below example, you should read the parts on multi-state work and also contact the HR department at the university.

Note! The below rules only apply to EU citizens within the EU/EEA. If your secondary job concerns work or an employer outside the EU/EEA, you should contact the HR department. If you are a non-EU citizen, you should contact the HR department before you take up any secondary jobs outside Denmark.

11 Situations, when it is always possible to have a secondary job abroad

In the below situation it is always possible to be covered by Danish social security if you have a secondary job outside Denmark. It does not matter where in the EU/EEA the work is performed, or if the employer is Danish or foreign.

The reason why the situations do not give cause to any problems is that you as a member of a Danish university staff is a civil servant, and as a main rule you will always be covered by Danish social security when you work abroad.

11.1 Residence in Denmark – secondary job for one or more private employers abroad

When you live in Denmark, you may take up secondary jobs for private employers abroad and in Denmark without it affecting your social security. It does not matter if you perform the work in Denmark or abroad.

You should contact Udbetaling Danmark and apply for a decision stating that you are covered by Danish social security. You will receive an A1 certificate as valid documentation in the EU that you are covered by Danish social security and that you do not have to pay social contributions abroad. Make sure to provide a copy of the A1 certificate to the university.

The rules are further described in section 4.3.3.

11.2 Residence abroad – secondary jobs for one or more private employers abroad

Even if you live abroad you may take up secondary jobs for private employers abroad and in Denmark without it affecting your social security. It does not matter if you perform the work in Denmark or abroad.

You should contact the authorities in your country of residence and apply for a decision stating that you are covered by Danish social security. You will receive an A1 certificate as valid documentation in the EU that you are covered by Danish social security and that you do not have to pay social contributions abroad. Make sure to provide a copy of the A1 certificate to the university.

The rules are further described in section 4.3.3.

11.3 Residence in Denmark – two (or more) secondary jobs as a civil servant in two (or more) other EU/EEA member states than Denmark

When you have a residence in Denmark and have two or more secondary jobs for two or more public employers in two different EU/EEA member states outside Denmark, you will always be covered by Danish social security.

Remember that it is always the rules in the individual country, whose administration the public employer belongs to, which determine if you are a civil servant in relation to coordination of social security. If you are in doubt, you should contact the authorities in the countries in question.

Remember that the work in each country may not be marginal, i.e. the work in each country must constitute at least 5% of the total work. Otherwise, the work in that country is not included.

You should contact Udbetaling Danmark and apply for a decision stating that you are covered by Danish social security. You will receive an A1 certificate as valid documentation in the EU that you are covered by Danish social security and that you do not have to pay social contributions abroad. It is common that the authorities only issue a certificate for one year. Thus, you have to apply for a new certificate upon expiry. Make sure to provide a copy of the A1 certificate to the university.

12 Situations, when it is sometimes possible to have a secondary job abroad

12.1 Residence in Denmark – secondary job as a civil servant in one EU/EEA member state outside Denmark

When you have a residence in Denmark, you should pay attention to your social security if you take up a secondary job as a civil servant for an employer in another EU/EEA country.

In this situation, you will be covered by Danish social security if a significant part of the work is performed in Denmark. Significant part means 25% or more of the total work.

You should contact Udbetaling Danmark and apply for a decision stating that you are covered by Danish social security. You will receive an A1 certificate as valid documentation in the EU that you are covered by Danish social security and that you do not have to pay social contributions abroad. It is common that the authorities only issue a certificate for one year. Thus, you have to apply for a new certificate upon expiry. Make sure to provide a copy of the A1 certificate to the university.

The rules are further described in section 4.3.4.

12.2 Residence abroad – secondary job as a civil servant in one EU/EEA country outside Denmark

When you have a residence abroad, you should pay attention to your social security if you take up a secondary job as a civil servant for one or more employers in your country of residence.

In this situation, you will be covered by Danish social security if a non-significant part of the work is performed in your country of residence. Non-significant means less than 25% of the total work. If you perform a significant part of the work in your country of residence (i.e. 25% or more), you will be covered by social security in your country of residence.

You should contact the authorities in your country of residence and apply for a decision stating which country’s rules you are covered by. You will receive an A1 certificate as valid documentation in the EU of which rules you are covered by and where to pay social contributions. It is common that the authorities only issue a certificate for one year. Thus, you have to apply for a new certificate upon expiry.

You should contact the HR department at your places of work and inform them of the situation as it affects your employers that you are covered by social security in your country of residence.

The rules are further described in section 4.3.4.

13 Situations, when it is never possible to have a secondary job abroad

13.1 Residence abroad – secondary job as a civil servant in one EU/EEA member state outside Denmark and your country of residence

When you have a residence abroad and one or more secondary jobs as a civil servant in one or more EU/EAA country outside Denmark and your country of residence, you will be covered by social security in your country of residence.

Remember that it is always the rules in the individual country, whose administration the public employer belongs to, which determine if you are a civil servant in relation to coordination of social security. If you are in doubt, you should contact the authorities in the countries in question.

Remember that the work in each country must not be marginal, i.e. the work in each country must constitute at least 5% of the total work. Otherwise, the work in that country is not included.

You should contact the authorities in your country of residence and apply for a decision stating which country’s rules you are covered by. You will receive an A1 certificate as valid documentation in the EU of which rules you are covered by and where to pay social contributions. It is common that the authorities only issue a certificate for one year. Thus, you have to apply for a new certificate upon expiry.

You should contact the HR department at your places of work and inform them of the situation as it affects your employers that you are covered by social security in your country of residence.

The rules are further described in section 4.3.4.

HOW TO HANDLE INTERNATIONAL UNIVERSITY EMPLOYEES – INFORMATION TO THE UNIVERSITY

14 How to handle university employees posted abroad

The university should make sure to discuss with the university employee in which country the university employee will be covered by social security during the posting. Most often, the university and the university employee will both wish the university employee to be covered by Danish social security.

The university will be able to decide where the university employee will be covered by social security via the posting contract as the posting conditions typically concern the university employee’s situation at the beginning of the posting period. The conditions governing the posting situation involves you (i.e. there is an ongoing work relation between the university and the university employee, and the university must maintain the necessary activities in Denmark).

However, there is a number of factors that can affect the university employee during the posting without necessarily involving the university. The university employee should be informed that he/she may not do any of the following without first informing the university:

- Enter into an agreement on salary or working conditions with the receiving institution.

- Take up other paid work or occupation as self-employed (secondary job).

- Be re-posted, i.e. the receiving institution re-posts the university employee to a third institution.

- Take over a job from another posted person during the posting.

During the posting, the university must make sure that all obligations under Danish law on social security are observed.

In particular:

- The university employee’s and the Danish university’s rights and obligations in connection with payment to ATP (the Danish Labour Market Supplementary Pension Fund). The Danish employer must withhold and pay the university employee’s and employer’s contribution to ATP. In addition, contributions to AES (the Labour Market Occupational Diseases Fund), AUB (Employers’ Reimbursement System), etc., have to be paid.

- Social security in connection with tax. The university must pay and withhold ATP even if the university employee is not liable to Danish tax.

- The university employee’s and Danish university’s rights and obligations in case of the university employee’s illness. Both the university employee and the employer must observe the Danish rules on illness, including the Danish Act on Benefits in the event of Illness or Childbirth. The university employee has to report any absence due to illness to the Danish university unless the university has made other agreements with the receiving university and the university employee has been informed thereof. The Danish university must pay salary during illness according to applicable rules and can claim a refund from the Danish municipality.

- The university employee’s and Danish university’s rights and obligations in case of possible maternity leave. The university employee is obliged to observe the Danish Act on Entitlement to Leave and Benefits in the Event of Childbirth towards the Danish university. It is not sufficient to give notice to the foreign university unless otherwise has been agreed between the universities. The university employee has the same rights to leave, etc., as if the work was performed in Denmark. The Danish university can claim a refund from the Danish municipality according to the same rules as if the university employee had worked in Denmark.

- The university employee’s and Danish university’s rights and obligations in case of a possible work-related injury. The Danish university and the university employee have the same rights and obligations in case of a work-related injury as when the university employee performs work in Denmark. If the posted university employee experience a work-related injury, it is important that the university employee and the university observe Danish rules and report the injury.

15 How to handle university employees posted to Denmark

The university should make sure that a decision has been made as to where the university employee is covered by social security.

If the university employee is employed directly at the Danish university and covered by Danish social security, the university employee should be treated as any other employee.

The situation is different if the university employee is posted to Denmark from another university and covered by the home country’s social security. The university employee will be covered by social security in the home country and the Danish university will not be considered as the employer according to the social security rules.

When a university employee is covered by the home country’s social security, you should discuss the implications with the university employee.

There is a number of employment terms that are technically categorized as social security terms. This means that these employment terms will only be governed by the rules in the university employee’s home country and not by Danish law.

In particular:

- The university employee’s and Danish university’s rights and obligations in case of the university employee’s illness.

- The university employee’s and Danish university’s rights and obligations in case of possible maternity leave.

- The university employee’s and the Danish university’s rights and obligations in case of a work-related injury.

The university employee posted to Denmark will typically have a foreign employer. The foreign employer is obliged to pay social contributions. The Danish university does not pay social contributions.

It is thus important if the Danish university enters into a relationship with the university employee in which the Danish university will be considered being the employer. In particular if:

- The Danish university enters into an (employment) agreement with the university employee. It is unclear if the Danish university may enter into agreements of a more administrative or technical nature, e.g. concerning the use of IT equipment, research facilities or handing out keys/access cards. However, there are no guidelines defining such agreements and if you want to be sure, as a Danish university, that you do not enter into an employer relationship, you should not enter into any written agreements with the university employee stating the conditions for the university employee’s terms. It will be possible to enter into an agreement with the foreign university being the employer.

- You may not enter into an agreement according to which the university directly defrays part of the university employee’s salary. You may not defray part of the university employee’s private expenses. It does not matter if the expenses are subject to tax. E.g., the Danish university may not provide free accommodation or free telephone.

If the university enters into an agreement with the university employee on salary or work conditions, the information should be part of the material based on which the foreign authorities make their decision. Other authorities’ practice varies in the individual EU/EEA countries. It cannot be excluded that some authorities will accept that the university has entered into an agreement with the university employee.

If the foreign authorities do not accept an agreement with the university employee, it should be examined if foreign practice accepts a third-party agreement, i.e. an agreement between the foreign employer, the university employee and the Danish university, which determines that the foreign employer is the main employer and also includes certain rights and obligations between the university employee and the Danish university.

If foreign practice does not accept any agreement between the Danish university and the university employee, it should be examined if the foreign authorities will enter into an agreement with the Danish authorities (The Ministry of Children, Gender Equality, Integration and Social Affairs), which allows the university employee to be covered by the home country’s social security. It should be examined if the university in such case has to pay foreign social contributions of part of the salary or private expenses defrayed by the university on behalf of the university employee.

16 How to handle multi-state workers

It is important that the question on social security is determined before employing a multi-state worker.

It is important to discuss:

- In which country you want the university employee to be covered by social security.

- How to achieve social security coverage in the country in question.

During the discussion with the university employee you should also consider what Danish or foreign social security will mean for the university employee and the university, respectively.

You should note that it can be a burden for you as a university to be covered by foreign social security. You risk having to register abroad and pay foreign social contributions that are most likely higher than the Danish contributions.